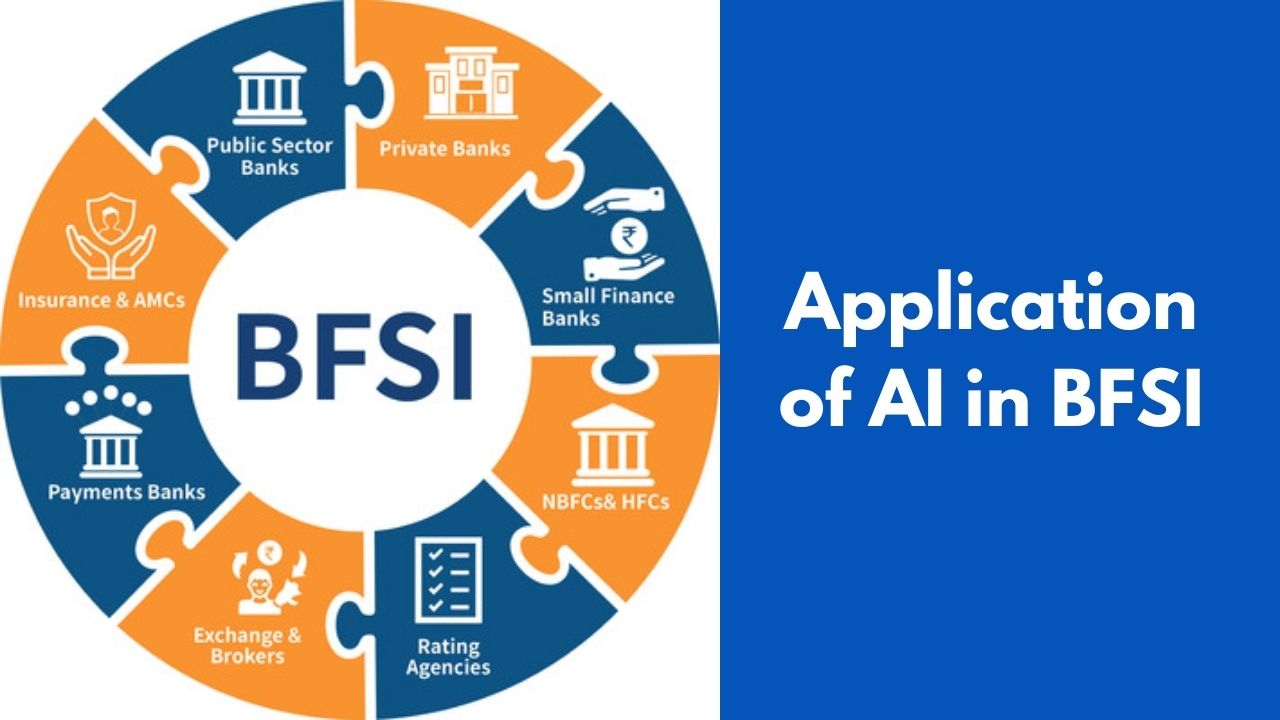

Application of AI in Banking, Finance, Security and Insurance (BFSI)#

Introduction#

The banking, financial services, and insurance (BFSI) sector has been at the forefront of adopting cutting-edge technology to streamline operations, improve customer experience, and reduce costs. Machine learning (ML) has been one of the most promising technologies in this regard, offering numerous opportunities to automate manual processes, make accurate predictions, and provide real-time insights. ML algorithms can be used to analyze vast amounts of customer and transactional data, providing insights into customer behavior, fraud detection, and more. The implementation of ML in BFSI has been helping organizations to drive operational efficiency, reduce costs, and stay ahead of the competition.

The banking, financial services, and insurance (BFSI) sector has been continuously exploring new ways to enhance the customer experience and improve operational efficiency. One of the key areas of focus has been the integration of computer vision, natural language processing (NLP), and audio processing technologies. Computer vision algorithms can be used to analyze images and videos, NLP algorithms can process and understand human language, and audio processing algorithms can process speech. These technologies offer numerous opportunities to automate manual processes, improve customer engagement, and provide real-time insights into customer behavior. By leveraging the power of computer vision, NLP, and audio processing, BFSI organizations can drive innovation, improve customer satisfaction, and gain a competitive edge in the market.

These usecases can invole technologies like classical machine learning, timeseries forecast, computer vision, nlp, deep learning, GAN etc.

Important Usecases of AI in BFSI#

Customer Facing, Sales & Marketing.#

- Customer service: AI can be used to provide personalized customer service through chatbots and virtual assistants, improving the customer experience and reducing wait times.

- Customer engagement: AI algorithms can be used to analyze customer engagement data and provide personalized marketing and engagement strategies, improving customer retention and satisfaction.

- Customer segmentation: AI algorithms can be used to segment customers based on their financial behaviors and provide personalized product recommendations, improving the customer experience.

- Customer sentiment analysis: AI algorithms can be used to analyze customer sentiment, providing insights into customer satisfaction and ways to improve the customer experience.

- Chatbot sentiment analysis: AI algorithms can be used to analyze customer sentiment during chatbot interactions, improving the customer experience and increasing customer satisfaction.

- Customer lifetime value prediction: AI algorithms can be used to predict the lifetime value of a customer, providing insights into ways to improve customer retention and satisfaction.

- Customer behavior analysis: AI algorithms can be used to analyze customer behavior, providing insights into ways to improve customer engagement and satisfaction.

- Marketing automation: AI algorithms can be used to automate marketing processes, improving the efficiency and effectiveness of marketing campaigns.

- Cross-selling and upselling: AI algorithms can analyze customer data and provide personalized product recommendations, improving the cross-selling and upselling opportunities for banks.

- Financial advice: AI algorithms can be used to provide financial advice, improving the customer experience and providing personalized financial recommendations.

- Customer service: AI can be used to provide personalized customer service through chatbots and virtual assistants, improving the customer satisfaction and reducing wait times.

- Chatbots: AI chatbots can be used to provide instant customer service, improving the customer experience and reducing wait times.

Operations#

- Fraud detection: AI algorithms can be used to detect potential fraud in real-time, reducing the risk of financial losses for banks and their customers.

- Fraud prevention: AI algorithms can be used to prevent fraud by analyzing customer behavior patterns and detecting unusual activity, reducing the risk of financial losses for banks and their customers.

- Loan underwriting: AI algorithms can be used to automate the loan underwriting process, providing faster and more accurate loan decisions for borrowers.

- Investment management: AI algorithms can be used to analyze investment data and provide personalized investment recommendations, improving the efficiency of investment management.

- Cybersecurity: AI algorithms can be used to improve cybersecurity, protecting sensitive financial information and reducing the risk of cyber attacks.

- Compliance: AI algorithms can be used to automate compliance processes and reduce the risk of compliance violations, improving the efficiency and accuracy of compliance management.

- Loan servicing: AI algorithms can be used to automate loan servicing processes, reducing the risk of loan defaults and improving the efficiency of loan servicing.

- Credit scoring: AI algorithms can be used to automate the credit scoring process, providing faster and more accurate credit decisions for borrowers.

- Predictive analytics: AI algorithms can be used to predict customer behaviors and provide insights into ways to improve customer engagement and satisfaction.

- Predictive maintenance: AI algorithms can be used to predict when equipment will fail, reducing downtime and improving maintenance efficiency.

- AI-powered KYC and AML: AI algorithms can be used to automate the Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, improving the efficiency and accuracy of compliance management.

- Algorithmic trading: AI algorithms can be used to automate trading decisions, improving the efficiency and accuracy of trading strategies.

- Wealth management: AI algorithms can be used to provide personalized wealth management services, improving the customer experience and providing personalized investment recommendations.

- Predictive credit scoring: AI algorithms can be used to predict credit risk, providing faster and more accurate credit decisions for borrowers.

- Data management: AI algorithms can be used to manage data, improving the efficiency and accuracy of data management processes.

- Credit default prediction: AI algorithms can be used to predict loan defaults, reducing the risk of loan defaults and improving loan management.

- Predictive pricing: AI algorithms can be used to predict pricing trends, improving the efficiency and accuracy of pricing strategies.

- Compliance: AI algorithms can be used to automate compliance processes and reduce the risk of compliance violations, improving the efficiency and accuracy of compliance management.

Insurance#

- Underwriting: AI algorithms can be used to automate the underwriting process, improving the speed and accuracy of underwriting decisions.

- Claims processing: AI algorithms can be used to automate the claims processing process, reducing the time required to process claims and improving the customer experience.

- Personalized pricing: AI algorithms can be used to personalize insurance pricing based on individual risk profiles, improving the customer experience and increasing customer satisfaction.

- Risk management: AI algorithms can be used to analyze financial data and predict potential risks, helping insurance companies to better manage risk and reduce potential losses.

Comments: